Do you have a financial plan to support you after you leave your job and before your online business is profitable? What about a plan for healthcare? Or Backup plans if you exhaust your savings?

Introducing a complimentary guide…

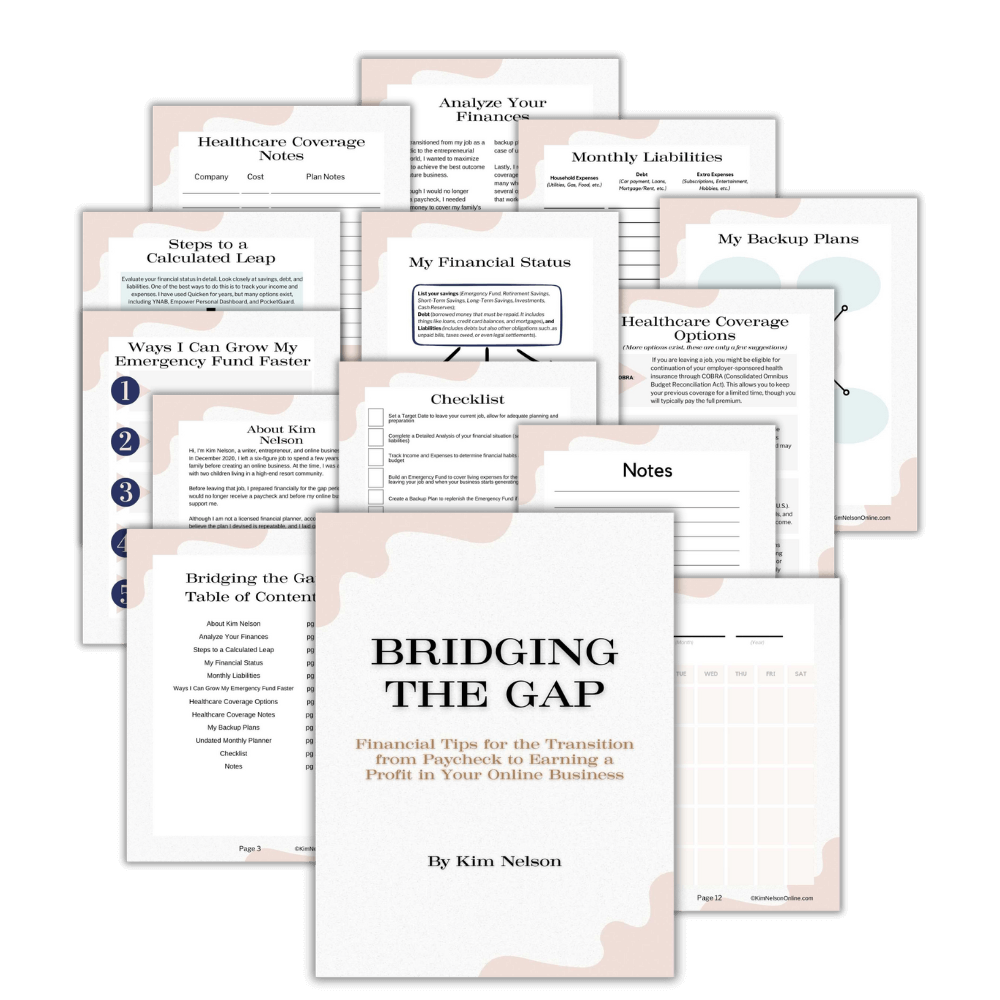

BRIDGING THE GAP

Financial Tips for the Transition from Paycheck to Earning a Profit in Your Online Business

A practical guide by Kim Nelson* to smooth your financial transition from employee to entrepreneur

Hi, I’m Kim Nelson*, a writer, entrepreneur, and online business owner. In December 2020 as a single mom with two children, I left a six-figure job to focus on my family before starting my online business. Before I left my job, I created a financial plan that would support my family and me during the period when I no longer received a paycheck and when my business would make enough money to again support us.

This 14-page guide is based on the financial strategies I used. While I’m not a licensed financial professional, the framework I used has worked very well for me and I believe it is repeatable for others willing to make the effort.

What You’ll Learn

- Analyze Your Finances: Understand your current financial status, including savings, debt, and liabilities.

- Steps to a Calculated Leap: Practical steps to prepare financially for the gap period.

- Financial Status Tracker: Tools and templates to track your savings, debts, and liabilities.

- Healthcare Coverage Options: Explore various healthcare options to cover your needs during the transition.

- Backup Plans: Ideas for additional income sources to support you while building your business.

Claim your Complimentary Guide here:

Enter your details below to get immediate access to the guide and start planning your financial transition today!

*DISCLAIMER: Kim Nelson is not a financial advisor. While I am experienced in my own financial planning, I am not your personal financial advisor, and nothing in this document, on my website KimNelsonOnline.com, downloads, emails, or content available should be construed as creating a client-advisor relationship. Additionally, nothing in the resources provided should be considered financial advice. The content in this document is intended for educational and informational purposes only. The author is not liable for any losses or damages related to actions taken or not taken based on the content, downloads, or resources available in this document, and on or through my website KimNelsonOnline.com. For specific financial advice, consult with a certified financial advisor who specializes in your area of concern.