Personal Finance Organization Tips

The First Step to Becoming an Entrepreneur

If you’re thinking about leaving your W-2 job to become an entrepreneur, let me tell you from experience that getting your personal finances in order is step one. While you need to pay off debt and cut expenses, the most critical part is to set up a solid financial foundation. You’ll need it to support you during the uncertain early days of entrepreneurship. Before you jump into your dream business, take the time to organize your finances using these practical personal finance organization tips.

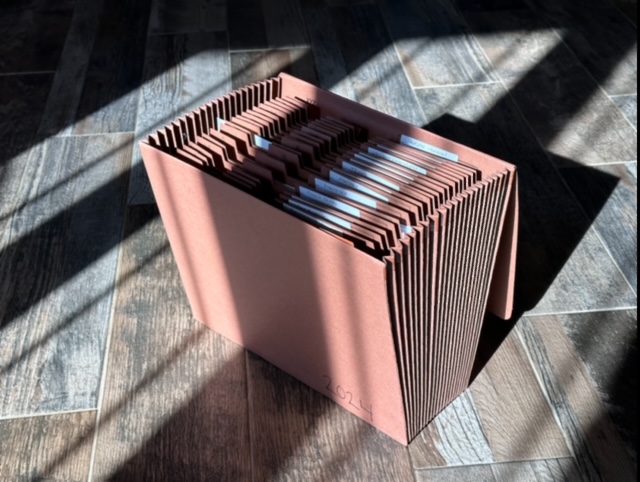

1. Set Up a Dedicated Space for Financial Documents

One of the most basic yet essential tips for personal finance organization is to create a dedicated space for all your financial paperwork. You can use a filing cabinet, a box, or even a set of digital folders on your computer. I use a new accordion file each year and have all my important documents in one place. This is essential.

As someone who used to have random receipts and bills shoved into drawers, trust me when I say this will save you from headaches down the road. Not only will it help with taxes, but when you’re running a business, having organized personal finances will make it easier to track expenses and deductions.

2. Check Your Accounts Regularly to Stay on Top of Your Finances

Another essential personal finance organization tip is developing the habit of checking your accounts regularly. Whether it’s your bank accounts, credit cards, or loan balances, staying informed about your financial situation is critical when preparing for entrepreneurship.

Personally, I do this several times throughout the week. By making it a routine, you’ll catch any issues early, avoid unnecessary fees, and, most importantly, stay aware of your spending habits. Knowing where you stand financially gives you a clearer picture of what you can afford to invest in your business.

3. Automate Bill Payments to Simplify Your Financial Routine

One of the best personal finance organization tips I can give is to automate as much as you can. When you have multiple bills with different due dates, keeping track manually can be stressful. Set up automatic payments for all your recurring bills—credit cards, utilities, subscriptions—so you never miss a payment.

Not only does this reduce the mental load of remembering due dates, but it also helps prevent late fees. Your aim needs to be keeping more money in your pocket to go toward your entrepreneurial goals. A bonus tip is to use a rewards card for these recurring expenses. Those reward miles and points will stack up that much faster when used to pay utilities and other recurring expenses!

4. Keep Digital Copies of Receipts for Major Purchases

Keeping organized records of your significant purchases is one of the more specific, but equally important, personal finance organization tips. Whether it’s for tax deductions, warranties, or business expense tracking, you need a system for holding onto receipts and documents.

My advice? Go digital. Use apps like Dropbox or Google Drive to save copies of receipts and label them clearly. This way, when tax season rolls around (especially if you’re self-employed), you’ll have everything you need in one place without the hassle of rummaging through piles of paper.

5. Conduct Regular Financial Reviews

One top personal finance organization tip is to review your finances regularly – at least once a month. This is your chance to examine your income, expenses, debt, and savings in-depth and see if you’re on track to meet your financial goals.

When I started doing regular financial reviews, I noticed patterns in my spending that I hadn’t seen before, like unnecessary subscriptions and impulse purchases. Catching these habits early allowed me to reallocate those funds toward my business savings.

6. Organize Your Bank and Credit Card Statements by Month

Organizing your bank and credit card statements by month is another key personal finance organization tip that can make a big difference in tracking your spending. I like to keep digital folders sorted by year and month, so I can easily pull up a statement whenever needed.

This level of organization not only helps you spot trends in your spending but also simplifies things when it comes time to prepare for taxes or apply for a business loan. Having easy access to your financial history is extremely important when you’re transitioning from employee to entrepreneur.

7. Create a Budget and Stick to It

Creating and sticking to a budget is the cornerstone of all personal finance organization tips. Before you can consider investing in a business, you need to clearly understand where your money is going.

Start by listing your regular expenses, including rent/mortgage, groceries, transportation, and debt payments. Then, set limits on discretionary spending and include a section for savings—both for personal and business-related goals.

I’ve used Quicken for years and love it. It helps me stay accountable and see my progress in real time. But if Quicken isn’t for you, I’ve also heard excellent feedback about budgeting apps like YNAB and Monarch.

8. Start Saving for Retirement Early, Even as an Entrepreneur

This one is often overlooked among all the tips for personal finance organization. Start saving for retirement now, not later. Even if you’re transitioning into entrepreneurship, and cash is tight, try to set aside a portion of your income for retirement.

Self-employed individuals can contribute to retirement accounts like a SEP IRA or Solo 401(k). The earlier you start, the more time your investments have to grow. Plus, building this habit while still in the early stages of your business can prevent you from falling behind on your long-term financial goals.

9. Pay Down High-Interest Debt to Reduce Financial Strain

One of the most important personal finance organization tips for aspiring entrepreneurs is to avoid high-interest debt at all costs. If you already have debt, prioritize paying it down before you jump into entrepreneurship.

High-interest credit card debt can quickly drain your resources, limiting the amount of money you can put toward your business. Focus on paying down your highest-interest debt first (using the debt avalanche method) or start with the smallest balances (utilizing the debt snowball method). Whichever approach you choose, clearing that debt is critical to freeing up cash flow for your future business.

10. Seek Professional Help if You’re Overwhelmed

If organizing your finances feels like an uphill battle, there’s no shame in seeking help. One final personal finance organization tip is to consult with a financial advisor or accountant who can help you create a plan tailored to your goals.

When I felt overwhelmed by my financial situation, a friend referred me to a certified financial planner. Given my then-current financial status, he put all my information into a format that showed me what my financial path looked like. He helped me figure out where I was going wrong and provided personalized advice on saving, budgeting, and investing. If you plan to start a business, a financial professional can help you navigate the complexities of separating personal and business finances.

Personal Finance Organization is Key to Entrepreneurial Success

Mastering these personal finance organization tips is essential before transitioning into entrepreneurship. You can’t expect to run a successful business if your financial life is chaotic. By setting up systems, automating payments, reviewing your accounts regularly, and tackling debt head-on, you’ll set yourself up for a much smoother transition.

Take control of your finances now, and when the time comes to focus on your business, you’ll be able to give it your full attention without worrying about the mess you left behind in your personal life.

I’m Kim Nelson, a writer, entrepreneur, and small business owner with over 20 years of experience. My career began as a partner in a successful photography business before I transitioned to selling physical products on Amazon FBA, including my own creations. I’m also the founder and owner of two websites. Download my complimentary guide, “Bridging the Gap,” to help you navigate the financial transition from leaving a steady paycheck to becoming a profitable entrepreneur.

This article is the second in a series I’m writing about transitioning from a W-2 job to entrepreneurship.

- Confidence to Make the Leap from Employee to Entrepreneur

- Personal Finance Organization Tips

- Building Your Escape Fund

- 8 Steps to Financial Planning for Entrepreneurs